Wilmar International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wilmar International Bundle

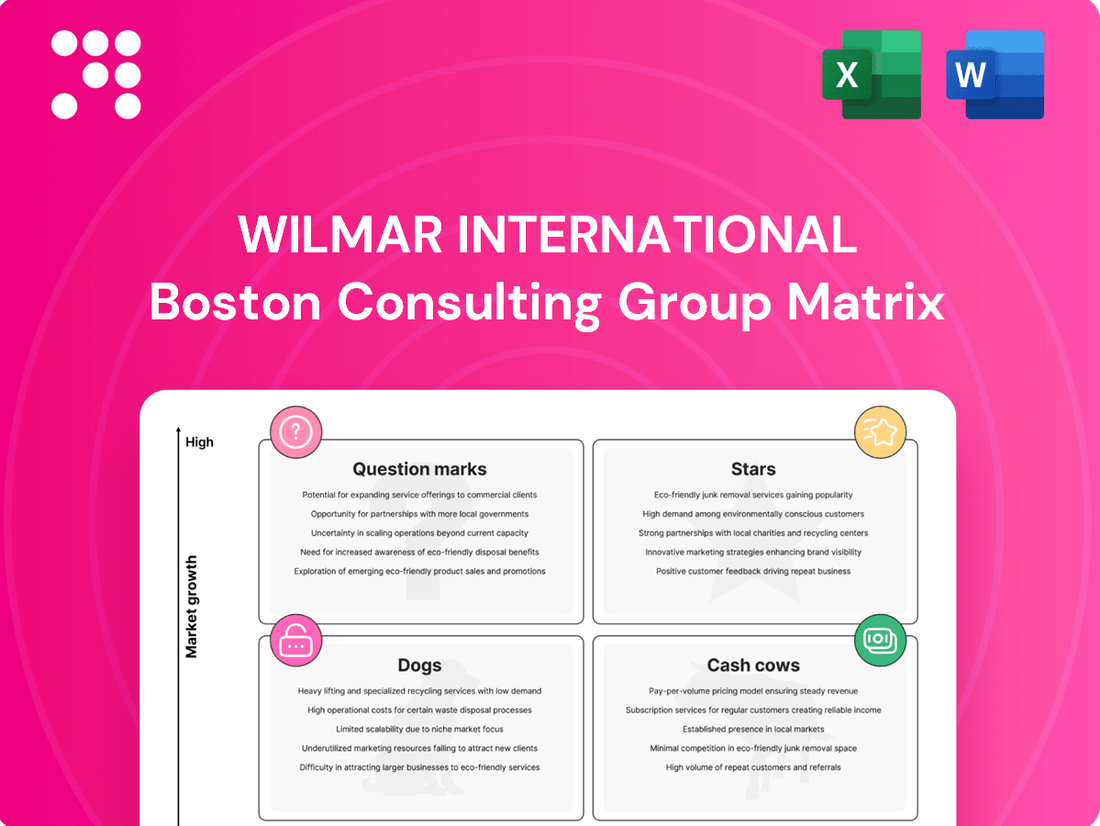

Wilmar International's diverse portfolio spans agribusiness, food processing, and consumer products, each with unique market growth and share dynamics. Understanding where these segments fall on the BCG Matrix – as Stars, Cash Cows, Dogs, or Question Marks – is crucial for strategic resource allocation and future growth.

This preview offers a glimpse into the potential positioning of Wilmar's key business units. To truly unlock actionable insights and develop a robust strategy for navigating its complex market landscape, dive deeper into the full BCG Matrix report.

Purchase the complete BCG Matrix for Wilmar International to gain a clear, data-driven understanding of its product portfolio's performance and receive tailored strategic recommendations for optimizing investments and driving sustainable growth.

Stars

Wilmar International is a powerhouse in Asia's consumer packaged food sector, particularly in cooking oils. They are the leading producer in major markets like China, India, and Indonesia. This dominance is fueled by the region's growing appetite for processed foods and edible oils.

The company's food products division has been performing well. In recent periods, they've seen better earnings and steady sales growth. This demonstrates Wilmar's strong footing in a sector that continues to expand.

Looking ahead to 2025, Wilmar is focused on boosting its market share in this segment. They aim to leverage their established reputation for quality and healthy food options to capture more of this expanding market.

Wilmar International is strategically acquiring a majority stake, around 64%, in Adani Wilmar Limited (AWL) Agri Business in India. This acquisition is a significant move to bolster Wilmar's footprint in India's booming packaged food and edible oil sector. AWL, recognized for its Fortune brand of edible oils and other essential consumer goods, represents a high-growth opportunity, substantially increasing Wilmar's market share.

Wilmar International's Food Park project in China is a significant undertaking, with multiple central kitchen facilities and food parks either operational or in various stages of construction. This expansion directly targets the increasing consumer preference for convenient, ready-to-eat, and healthier food choices within China's dynamic market.

By 2024, China's food and beverage market was projected to reach approximately $1.2 trillion, with a substantial portion driven by convenience foods and food service. Wilmar's investment in central kitchens and food parks positions it to capture a considerable share of this growth, leveraging its existing supply chain and distribution networks.

The strategic expansion into central kitchen products within these food parks signifies Wilmar's commitment to innovation and market leadership. The company aims to solidify its presence in a high-growth sector, anticipating strong returns as Chinese consumers increasingly embrace modern food solutions.

Plant-Based Proteins and New Healthier Food Options

Plant-based proteins and new healthier food options are a key area of focus for Wilmar International, aligning with a growing global demand for wellness and sustainability. The company is investing heavily in research and development to innovate in this space.

Wilmar has already launched new rice, wheat flour, and edible oil products in China, catering to the increasing consumer preference for healthier choices. This strategic move positions them to capitalize on a high-growth market segment driven by evolving dietary trends.

- Market Growth: The global plant-based food market is projected to reach USD 162 billion by 2030, indicating substantial growth potential.

- Product Innovation: Wilmar's investment in R&D for healthier options, including plant-based proteins, is crucial for capturing this expanding market.

- Geographic Focus: The initial launch of healthier food products in China highlights a strategic entry into a key market with significant consumer interest in wellness.

- Strategic Intent: Despite being newer ventures, Wilmar's substantial investments signal a clear ambition to secure a significant share of the burgeoning healthier food market.

Global Processing and Merchandising of Edible Oils (High-Value Segments)

Wilmar International's Global Processing and Merchandising of Edible Oils, especially in the consumer pack segment, represents a significant strength. This segment is a cornerstone of their business, leveraging their extensive global network and integrated supply chain.

The company's leadership in processing and merchandising edible oils, particularly in consumer packs, positions it to benefit from rising global demand for these essential food items. Wilmar's integrated operations and considerable scale are key factors in maintaining its robust market standing.

- Market Position: Wilmar is a global leader in edible oil processing and merchandising, with a particularly strong presence in the consumer pack sector.

- Growth Drivers: The segment benefits from increasing global demand for edible oils, driven by population growth and changing dietary habits.

- Competitive Advantage: Wilmar's integrated business model, from sourcing raw materials to distribution, provides significant cost efficiencies and market control.

- Financial Performance: In 2023, Wilmar reported revenue of approximately $69.1 billion, with its agribusiness segment, which includes edible oils, being a major contributor.

Wilmar's plant-based protein and healthier food options, while newer ventures, represent significant potential growth areas. The company is investing heavily in R&D and product launches in key markets like China, aiming to capture a share of the expanding wellness-focused food sector. This strategic focus aligns with global consumer trends towards healthier and sustainable eating habits.

What is included in the product

Wilmar International's BCG Matrix analyzes its diverse portfolio, identifying growth opportunities and areas for resource allocation.

A clear Wilmar International BCG Matrix visually clarifies which business units require investment and which can be divested, easing strategic decision-making.

Cash Cows

Wilmar International's established palm oil cultivation and refining operations are a prime example of a Cash Cow in the BCG matrix. The company is a dominant force, ranking among the largest oil palm plantation owners globally and a leader in palm oil refining.

These core businesses are mature and consistently produce significant cash flow for Wilmar. For instance, in 2023, Wilmar reported a net profit attributable to shareholders of $1.07 billion, with its agribusiness segment, which includes palm oil, being a major contributor.

While palm oil prices can fluctuate, the sheer scale and operational efficiency of Wilmar's integrated palm oil value chain ensure stable and reliable profitability. This consistent cash generation is vital for Wilmar, providing the financial muscle to invest in and support its other business units and growth strategies.

Wilmar International's large-scale oilseed crushing operations are a prime example of a Cash Cow. This segment is a powerhouse in Asia, driving a substantial portion of the company's sales volume and generating consistent cash flow thanks to its dominant market share and robust infrastructure.

Despite some variability in profit margins, the sheer scale of these operations ensures a reliable revenue stream, underpinning Wilmar's integrated agribusiness strategy. For instance, in 2024, Wilmar reported that its agribusiness segment, which heavily features oilseed crushing, contributed significantly to its overall financial performance, demonstrating the enduring strength of this business unit.

Wilmar's integrated sugar business, a mature segment, functions as a cash cow. This operation covers the entire value chain, from raw sugar production, where Wilmar is Australia's largest producer, through milling and refining to the creation of consumer goods.

Despite potential challenges in areas like merchandising, the segment consistently generates substantial cash flow. The mature nature of many sugar markets, characterized by low growth, reduces the necessity for significant reinvestment or aggressive marketing, thereby bolstering its cash-generating capabilities.

Oleochemicals and Palm Biodiesel Manufacturing

Wilmar International stands as a dominant force in the oleochemicals and palm biodiesel sectors, recognized globally as the largest manufacturer. These divisions cater to industrial markets where demand remains consistently strong, underpinning their status as cash cows within the company's business portfolio.

The significant market share held by Wilmar in these areas, coupled with steady, albeit moderate, demand from diverse industries, solidifies their cash-generating capabilities. This allows for a more measured approach to investment, focusing on maintaining operational efficiency rather than aggressive market expansion or promotion.

- Global Leadership: Wilmar is the world's largest producer of both oleochemicals and palm biodiesel.

- Stable Demand: These products serve industrial markets with consistent and predictable demand patterns.

- High Market Share: Wilmar benefits from a substantial market share in these established sectors.

- Cash Generation: The segments are reliable generators of cash, requiring less intensive investment compared to high-growth ventures.

Extensive Grain Processing, Merchandising, and Distribution Network

Wilmar International's extensive grain processing, merchandising, and distribution network is a cornerstone of its business, firmly placing it in the Cash Cows quadrant of the BCG Matrix. This vast infrastructure, covering everything from sourcing to delivery, generates consistent revenue streams.

The company's significant presence in global agricultural commodities, particularly grains, translates into a stable and predictable cash flow. This is largely due to the mature nature of these markets and Wilmar's established position within them.

In 2023, Wilmar reported revenue from its agribusiness segment, which includes these operations, of approximately $46.4 billion. This highlights the substantial contribution of its grain-related activities to the company's overall financial health.

- Consistent Revenue Generation: The sheer scale of Wilmar's grain processing and distribution network ensures a steady flow of business, contributing significantly to its cash cow status.

- Leveraging Existing Infrastructure: These operations benefit from established infrastructure and market relationships, minimizing the need for substantial new investments to maintain their strong market share.

- Market Dominance: Wilmar's deep integration across the agricultural value chain allows it to efficiently manage costs and maintain profitability in its grain-related businesses.

- Financial Stability: The agribusiness segment, driven by these core operations, consistently provides a reliable source of cash for the company, supporting investments in other areas.

Wilmar's established palm oil cultivation and refining operations are a prime example of a Cash Cow in the BCG matrix. The company is a dominant force, ranking among the largest oil palm plantation owners globally and a leader in palm oil refining.

These core businesses are mature and consistently produce significant cash flow for Wilmar. For instance, in 2023, Wilmar reported a net profit attributable to shareholders of $1.07 billion, with its agribusiness segment, which includes palm oil, being a major contributor.

While palm oil prices can fluctuate, the sheer scale and operational efficiency of Wilmar's integrated palm oil value chain ensure stable and reliable profitability. This consistent cash generation is vital for Wilmar, providing the financial muscle to invest in and support its other business units and growth strategies.

Wilmar International's large-scale oilseed crushing operations are a prime example of a Cash Cow. This segment is a powerhouse in Asia, driving a substantial portion of the company's sales volume and generating consistent cash flow thanks to its dominant market share and robust infrastructure.

Despite some variability in profit margins, the sheer scale of these operations ensures a reliable revenue stream, underpinning Wilmar's integrated agribusiness strategy. For instance, in 2024, Wilmar reported that its agribusiness segment, which heavily features oilseed crushing, contributed significantly to its overall financial performance, demonstrating the enduring strength of this business unit.

Wilmar's integrated sugar business, a mature segment, functions as a cash cow. This operation covers the entire value chain, from raw sugar production, where Wilmar is Australia's largest producer, through milling and refining to the creation of consumer goods.

Despite potential challenges in areas like merchandising, the segment consistently generates substantial cash flow. The mature nature of many sugar markets, characterized by low growth, reduces the necessity for significant reinvestment or aggressive marketing, thereby bolstering its cash-generating capabilities.

Wilmar International stands as a dominant force in the oleochemicals and palm biodiesel sectors, recognized globally as the largest manufacturer. These divisions cater to industrial markets where demand remains consistently strong, underpinning their status as cash cows within the company's business portfolio.

The significant market share held by Wilmar in these areas, coupled with steady, albeit moderate, demand from diverse industries, solidifies their cash-generating capabilities. This allows for a more measured approach to investment, focusing on maintaining operational efficiency rather than aggressive market expansion or promotion.

- Global Leadership: Wilmar is the world's largest producer of both oleochemicals and palm biodiesel.

- Stable Demand: These products serve industrial markets with consistent and predictable demand patterns.

- High Market Share: Wilmar benefits from a substantial market share in these established sectors.

- Cash Generation: The segments are reliable generators of cash, requiring less intensive investment compared to high-growth ventures.

Wilmar International's extensive grain processing, merchandising, and distribution network is a cornerstone of its business, firmly placing it in the Cash Cows quadrant of the BCG Matrix. This vast infrastructure, covering everything from sourcing to delivery, generates consistent revenue streams.

The company's significant presence in global agricultural commodities, particularly grains, translates into a stable and predictable cash flow. This is largely due to the mature nature of these markets and Wilmar's established position within them.

In 2023, Wilmar reported revenue from its agribusiness segment, which includes these operations, of approximately $46.4 billion. This highlights the substantial contribution of its grain-related activities to the company's overall financial health.

- Consistent Revenue Generation: The sheer scale of Wilmar's grain processing and distribution network ensures a steady flow of business, contributing significantly to its cash cow status.

- Leveraging Existing Infrastructure: These operations benefit from established infrastructure and market relationships, minimizing the need for substantial new investments to maintain their strong market share.

- Market Dominance: Wilmar's deep integration across the agricultural value chain allows it to efficiently manage costs and maintain profitability in its grain-related businesses.

- Financial Stability: The agribusiness segment, driven by these core operations, consistently provides a reliable source of cash for the company, supporting investments in other areas.

| Business Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Approx.) | Outlook |

| Palm Oil Cultivation & Refining | Cash Cow | Dominant global player, integrated value chain, stable profitability despite price volatility. | Significant portion of $46.4 billion Agribusiness revenue | Continued steady cash generation, focus on operational efficiency. |

| Oilseed Crushing | Cash Cow | Powerhouse in Asia, dominant market share, robust infrastructure. | Major contributor to Agribusiness segment performance. | Reliable revenue stream, supports integrated strategy. |

| Sugar Integrated Business | Cash Cow | Largest producer in Australia, full value chain coverage, low growth mature markets. | Consistent substantial cash flow. | Maintains profitability with minimal reinvestment needs. |

| Oleochemicals & Palm Biodiesel | Cash Cow | World's largest manufacturer, strong industrial demand, high market share. | Reliable cash generators. | Steady cash flow, focus on operational efficiency. |

| Grain Processing, Merchandising & Distribution | Cash Cow | Extensive network, stable commodity markets, established position. | Contributes significantly to $46.4 billion Agribusiness revenue. | Consistent revenue streams, leverages existing infrastructure. |

Preview = Final Product

Wilmar International BCG Matrix

The Wilmar International BCG Matrix you're previewing is the complete, unwatermarked document you'll receive immediately after purchase. This comprehensive analysis, crafted by industry experts, offers a clear strategic overview of Wilmar's diverse business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs. You'll gain actionable insights into their market share and growth potential, empowering informed decision-making for resource allocation and future investment strategies.

Dogs

Wilmar International's Feed and Industrial Products segment saw earnings dip in the latter half of 2024, with underperforming sugar merchandising activities being a key factor. This particular area within the segment has experienced a notable decrease in sales volume, suggesting both a limited market share and subdued growth prospects.

The decline in sugar merchandising sales volume, which dropped by approximately 15% year-on-year in 2H24, highlights its position as a potential cash trap. This sub-segment's consistent underperformance and the capital it ties up without yielding adequate returns warrant careful strategic consideration for Wilmar.

Wilmar International's tropical oils business faced a tough operating environment in the first quarter of 2025. Global demand for palm oil was expected to remain sluggish throughout 2025, largely because palm oil's price premium over soybean oil persisted.

Despite Wilmar's overall leadership in tropical oils, certain undifferentiated bulk operations experienced persistent margin pressure and declining demand. These specific segments, if they also held a low market share within their niche, could be classified as 'Dogs' in the BCG Matrix.

Inefficient or obsolete production assets within Wilmar International, despite the company's overall strength in integrated agribusiness, can be viewed as potential Dogs. These might be older plants struggling with high operational costs and an inability to meet evolving sustainability benchmarks, holding a minimal market share.

For instance, if a particular palm oil mill, acquired years ago, consistently reports higher processing costs per ton compared to newer, more technologically advanced facilities, it could fall into this category. In 2023, Wilmar reported a total revenue of $60.5 billion, and while specific asset-level efficiency data isn't publicly detailed, such underperforming units would drain resources without contributing proportionally to overall growth or market dominance.

Segments with Persistent Regulatory Headwinds in Specific Regions

Wilmar International encounters significant regulatory challenges, particularly in Indonesia. These challenges include potential land confiscations and ongoing investigations into alleged mislabeling of rice. Furthermore, the company faces scrutiny regarding corruption in palm oil export permits.

These persistent regulatory headwinds can severely impact specific regional operations or product lines. If these issues lead to a substantial and sustained decrease in market share and growth potential, those segments could be categorized as Dogs within Wilmar's BCG Matrix. For instance, in 2024, regulatory actions in Indonesia have already led to increased operational costs and uncertainty for agribusinesses.

- Regulatory Actions in Indonesia: Wilmar faces land confiscation risks and investigations into rice mislabeling and palm oil permit corruption.

- Impact on Market Share: Persistent regulatory issues can diminish market share and growth prospects for affected segments.

- BCG Matrix Classification: Segments disproportionately impacted by these headwinds may be classified as Dogs.

- 2024 Context: Increased operational costs and uncertainty are already evident for agribusinesses due to regulatory actions in Indonesia during 2024.

Non-Core, Early-Stage Ventures Failing to Scale

Wilmar International, like any diversified conglomerate, faces the challenge of nurturing new ventures. While innovation is key, some early-stage, non-core businesses may struggle to gain momentum. For instance, if a new venture in a niche agricultural technology, launched in early 2024, fails to secure significant market share or demonstrate a clear path to profitability by late 2024, it could be categorized as a potential dog.

The critical factor is the lack of traction and market adoption. If these smaller, non-core ventures, especially those reporting losses in the second half of 2024, do not show a compelling strategy for scaling in high-growth sectors, they become candidates for closer scrutiny. Wilmar's strategic review process would likely identify these ventures for potential restructuring or divestment.

- Venture Performance: Some non-core, early-stage businesses may not achieve expected market penetration or revenue growth.

- Financial Indicators: Ventures incurring losses in 2H2024 without a clear turnaround strategy are at risk.

- Strategic Re-evaluation: Businesses lacking a defined path to profitability in high-growth markets may be considered for divestment.

- Market Adoption: Failure to gain significant market share or customer adoption is a key indicator of a potential dog.

Segments within Wilmar International's portfolio that exhibit low market share and minimal growth potential, such as underperforming sugar merchandising or certain undifferentiated bulk tropical oil operations, can be classified as Dogs. These units often tie up capital without generating sufficient returns, as seen with the 15% year-on-year drop in sugar merchandising sales volume in 2H24.

Inefficient production assets or early-stage ventures failing to gain market traction by late 2024 also fit this category. For instance, older palm oil mills with higher processing costs or new agricultural technology businesses reporting losses in 2H2024 without a clear scaling strategy represent potential Dogs.

Persistent regulatory challenges, like those faced in Indonesia in 2024, can also create Dog categories if they lead to sustained market share erosion and reduced growth prospects for specific operations.

These 'Dogs' require careful strategic review, potentially leading to restructuring or divestment to reallocate resources to more promising areas of Wilmar's diversified agribusiness.

| BCG Category | Wilmar International Segment Examples (Potential) | Key Characteristics | 2024/2025 Outlook |

|---|---|---|---|

| Dogs | Underperforming Sugar Merchandising | Low market share, low growth, declining sales volume (e.g., 15% YoY drop in 2H24) | Continued margin pressure, potential cash trap |

| Dogs | Undifferentiated Bulk Tropical Oils | Low market share within niche, persistent margin pressure | Sluggish global demand for palm oil, price premium over soybean oil |

| Dogs | Inefficient/Obsolete Production Assets | High operational costs, minimal market share, struggle with sustainability benchmarks | Drain resources, require capital for upgrades or face obsolescence |

| Dogs | Struggling Early-Stage Ventures | Lack of market traction, low adoption, reporting losses in 2H2024 | Risk of restructuring or divestment if no clear path to profitability |

Question Marks

Wilmar International's strategy often involves introducing new consumer product variations, such as specialized rice, wheat flour, and edible oil lines, in key emerging markets like China. These launches are designed to tap into evolving consumer preferences and increasing purchasing power within these regions.

Currently, these newly launched products are positioned as 'Question Marks' in the BCG matrix. Despite targeting growing demands, they possess a low market share, necessitating substantial investment in marketing and distribution to build brand awareness and drive adoption.

Wilmar's investment in a Nigerian edible oils joint venture, acquiring a 50% stake, clearly signals a strategic move into high-potential emerging markets. This expansion aligns with the characteristics of a 'Question Mark' in the BCG Matrix, demanding significant capital for growth.

While Nigeria's edible oils market presents substantial growth opportunities, Wilmar's initial market share in this specific venture is expected to be low, reflecting the 'Question Mark' status. The company will need to invest heavily and focus strategically to build market leadership in this new territory.

Wilmar International's dedication to sustainability, evidenced by its Science Based Targets initiative (SBTi) validated emissions reduction goals and a strong No Deforestation, No Peat, No Exploitation (NDPE) policy, opens avenues for premium or niche product lines emphasizing their eco-friendly credentials. The market for such sustainable goods is expanding, but these specialized segments currently represent a small portion of Wilmar's overall sales, necessitating substantial investment for growth.

Digitally Driven Market Penetration Initiatives

Wilmar International is exploring digitally driven market penetration, aiming to tap into the burgeoning online consumer space. This strategy focuses on leveraging digital marketing to connect with a wider audience, recognizing it as a high-growth avenue for customer engagement and expanding its market footprint.

These specific digital initiatives, while promising, are still in their nascent stages. Their ultimate effectiveness and the market share gains they can achieve are yet to be fully realized, placing them in the 'Question Mark' category of the BCG Matrix. This signifies a need for strategic investment to nurture their potential and determine their future success.

- Digital Marketing Investment: Wilmar is allocating resources to digital advertising, social media engagement, and e-commerce platform development to reach new customer segments.

- E-commerce Growth Potential: The company sees significant opportunity in online sales channels, which are experiencing rapid expansion globally.

- Market Share Uncertainty: While digital channels offer broad reach, the actual market share gains from these initiatives are still under evaluation, requiring further data and performance analysis.

- Need for Strategic Funding: As a 'Question Mark,' these digital penetration efforts require continued investment to test and refine strategies, with the goal of transforming them into strong market performers.

Diversification into New Product Categories (e.g., Soy Sauce Production)

Wilmar International's expansion into soy sauce production, with a new facility in Yangjiang, China, positions this venture as a potential Star or Question Mark within its BCG Matrix. The Chinese soy sauce market is substantial, with consumption projected to reach over 15 million tons annually by 2025, indicating significant growth potential.

As a new entrant, Wilmar faces intense competition from established brands that hold considerable market share. This necessitates substantial capital expenditure to build brand recognition, establish distribution networks, and achieve competitive pricing, typical of a Question Mark needing investment to determine its future trajectory.

- Market Entry: Wilmar's soy sauce production facility in Yangjiang, China represents a strategic diversification into a new product category.

- Market Position: As a new player, Wilmar starts with a low market share in a large and growing Chinese soy sauce market, estimated to be worth billions of dollars.

- Investment Needs: Significant capital investment is required to challenge established competitors and capture meaningful market share in this segment.

- Strategic Outlook: This venture aligns with Wilmar's broader strategy of expanding its consumer food products segment, but its success hinges on effectively navigating a competitive landscape.

Wilmar's new product launches and market entries, such as specialized edible oils in Nigeria or soy sauce in China, are currently classified as Question Marks. These ventures target high-growth markets but begin with a low market share, demanding significant investment to build brand awareness and competitive positioning.

The company's digital marketing and e-commerce initiatives also fall into this category, representing promising but unproven avenues for growth. Wilmar's commitment to sustainability is fostering niche product lines that, while expanding, currently hold a small market share, requiring substantial capital to scale.

These Question Marks represent strategic bets on future growth areas, necessitating careful resource allocation and performance monitoring to determine their potential to become Stars or Cash Cows.

| Business Unit | Market Growth | Relative Market Share | BCG Category | Strategic Focus |

| Nigerian Edible Oils JV | High | Low | Question Mark | Investment for market penetration and brand building |

| Chinese Soy Sauce Venture | High | Low | Question Mark | Capital expenditure for brand recognition and distribution |

| Digital Marketing & E-commerce | High | Low | Question Mark | Testing and refining strategies for customer engagement |

| Sustainable Product Lines | Growing | Low | Question Mark | Investment to scale niche segments and leverage eco-credentials |

BCG Matrix Data Sources

Our Wilmar International BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.