Wilmar International Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wilmar International Bundle

Wilmar International's marketing prowess is built on a robust 4Ps strategy, from its diverse product portfolio to its intricate distribution networks. Understanding how they leverage pricing and promotion is key to grasping their market dominance.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Wilmar International's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Wilmar International's product strategy is deeply rooted in its integrated agribusiness model, presenting a diverse array of agricultural commodities and their derivatives. This includes core offerings like palm oil, oilseeds, grains, and sugar, which are fundamental to both industrial applications and consumer goods worldwide.

The sheer breadth of this product portfolio, encompassing raw materials and processed goods, enables Wilmar to effectively serve a global customer base with varied requirements. For instance, in 2023, Wilmar reported revenue from its agribusiness segment of $34.7 billion, highlighting the scale of its commodity trading and processing operations.

Wilmar International's consumer food segment is a cornerstone of its business, featuring a wide array of branded products like edible oils, rice, flour, and noodles. These items are geared for direct consumer use, with a strong emphasis on quality and adaptation to regional tastes, particularly across Asia and Africa. This strategy of focusing on consumer-packaged goods is key to building lasting brand recognition and customer loyalty.

In 2023, Wilmar reported that its Consumer Products segment, which includes food products, saw revenue increase by 7.6% to $22.1 billion. This growth was driven by strong performance in key markets and product categories, demonstrating the effectiveness of their consumer-centric approach. The company continues to invest in product innovation and marketing to further solidify its market position.

Wilmar International’s Feed and Industrial segment is a significant contributor beyond its core food business, encompassing animal feeds, specialty fats, oleochemicals, and biodiesel. These products are vital raw materials for numerous industries, establishing Wilmar as a critical supplier in manufacturing and energy. For instance, in 2023, Wilmar’s agribusiness segment, which includes feed and industrial products, reported revenue of approximately $22.4 billion, demonstrating the scale of its operations in these sectors.

This diversification into industrial applications leverages Wilmar's extensive processing capabilities and integrated supply chain. Oleochemicals, derived from palm oil and lauric oils, are essential components in personal care products, detergents, and plastics. Biodiesel, a renewable fuel, addresses growing demand for sustainable energy solutions, with Wilmar actively involved in its production and distribution.

Integrated Value Chain Offerings

Wilmar International's product strategy extends beyond individual goods to its entire integrated value chain. This means their offerings include everything from sourcing raw agricultural materials, like palm oil and sugar, through milling, refining, and finally to the finished consumer products. This comprehensive approach, covering cultivation to merchandising, is a core part of their product definition.

This integrated model provides significant advantages, allowing Wilmar to maintain stringent quality control at every stage. For example, their direct involvement in cultivation and milling ensures the quality of their primary inputs, which translates to higher quality end products. This end-to-end control also facilitates full traceability, a key selling point for consumers increasingly concerned about the origin and sustainability of their food.

The ability to offer products with verified sustainability credentials, such as RSPO-certified palm oil, is a direct result of this integrated value chain. By managing the entire process, Wilmar can implement and monitor sustainable practices from farm to fork. In 2024, Wilmar reported that over 90% of its palm oil is sourced from certified sustainable plantations, underscoring this commitment.

This deep control over the value chain enhances the overall value proposition of Wilmar's diverse product portfolio, which includes edible oils, sugar, flour, rice, and animal feed. Their integrated operations contributed to a robust financial performance, with Wilmar reporting a net profit of US$1.18 billion for the first half of 2024, demonstrating the commercial success of this product strategy.

- Integrated Product Scope: Encompasses the entire agricultural value chain from cultivation to merchandising, not just finished goods.

- Quality & Traceability: Rigorous control from origin ensures high-quality products with verifiable traceability.

- Sustainability Credentials: Facilitates the implementation and verification of sustainable practices across the value chain, with over 90% of palm oil certified sustainable as of 2024.

- Enhanced Value Proposition: The end-to-end control strengthens the appeal and marketability of their diverse product range.

Focus on Health and Sustainability Initiatives

Wilmar International is actively responding to shifting consumer demands and global sustainability trends by prioritizing healthy and responsibly sourced products within its marketing mix. This commitment is evident in their development of innovative food products designed to meet evolving health consciousness. For instance, their introduction of low-Glycemic Index (GI) rice caters to consumers seeking better blood sugar management, a significant health concern for many. Similarly, their high-Diacylglycerol (DAG) oil offers a healthier cooking oil alternative, aligning with the growing preference for functional food ingredients.

A cornerstone of Wilmar's sustainability efforts is its unwavering adherence to No Deforestation, No Peat, No Exploitation (NDPE) policies across its supply chain. This rigorous approach ensures that their raw materials, particularly palm oil, are sourced without contributing to environmental degradation or human rights abuses. This strategic emphasis not only differentiates Wilmar's offerings in a crowded market but also directly addresses the increasing consumer desire for ethically and sustainably produced goods. In 2023, Wilmar reported that over 90% of its palm oil supply base was covered by its NDPE policy, demonstrating tangible progress towards its ambitious sustainability goals.

This focus on health and sustainability initiatives serves as a key differentiator for Wilmar. By aligning its product development and sourcing practices with these critical global trends, the company is well-positioned to capture market share and build brand loyalty among a growing segment of environmentally and health-conscious consumers. Wilmar's investments in these areas are not just about corporate responsibility; they represent a strategic imperative to meet market demand and ensure long-term business viability in an increasingly regulated and discerning global marketplace.

- Wilmar's low-GI rice addresses growing consumer interest in blood sugar management.

- High-DAG oil offers a healthier cooking alternative, meeting demand for functional ingredients.

- Over 90% of Wilmar's palm oil supply base adhered to NDPE policies as of 2023.

- This strategic focus enhances product differentiation and meets demand for responsible consumption.

Wilmar International's product strategy is defined by its comprehensive, integrated agribusiness model, covering everything from raw material sourcing to finished consumer goods. This end-to-end control ensures high quality and traceability across its diverse portfolio, which includes edible oils, sugar, flour, rice, and animal feed. By managing the entire value chain, Wilmar can effectively implement and verify sustainable practices, a crucial factor for today's environmentally conscious consumers.

| Product Category | Key Offerings | 2023 Segment Revenue (approx.) | Key Differentiators |

|---|---|---|---|

| Agribusiness (Core Commodities & Processing) | Palm Oil, Oilseeds, Grains, Sugar | $22.4 billion | Integrated sourcing, processing, and trading |

| Consumer Products (Food) | Edible Oils, Rice, Flour, Noodles | $22.1 billion (up 7.6% from 2022) | Regional taste adaptation, brand building, health-focused innovation (e.g., low-GI rice) |

| Feed and Industrial | Animal Feeds, Oleochemicals, Biodiesel | Included in Agribusiness segment | Raw materials for various industries, renewable energy solutions |

Wilmar's product innovation focuses on health and sustainability, exemplified by low-GI rice and high-DAG oil. Adherence to No Deforestation, No Peat, No Exploitation (NDPE) policies, with over 90% of its palm oil supply base covered by 2023, further strengthens its market position. This strategic emphasis on responsible sourcing and healthier options directly addresses growing consumer demand and enhances product differentiation.

What is included in the product

This analysis provides a comprehensive breakdown of Wilmar International's marketing strategies, examining their Product offerings, Pricing tactics, Place (distribution) channels, and Promotion efforts.

It offers actionable insights into Wilmar's market positioning and competitive advantages, making it ideal for strategic planning and benchmarking.

Simplifies complex marketing strategies by clearly outlining Wilmar International's 4Ps, offering a clear path to address market challenges.

Provides a concise, actionable framework for understanding and optimizing Wilmar's product, price, place, and promotion strategies, easing marketing planning burdens.

Place

Wilmar International's extensive global manufacturing and distribution network is a cornerstone of its marketing strategy. With over 1,000 manufacturing facilities and a distribution reach covering China, India, Indonesia, and roughly 50 other nations, the company ensures efficient production and widespread product availability. This vast infrastructure, a significant competitive advantage, underpins its ability to serve diverse markets effectively.

Wilmar International leverages strategic regional hubs, especially in Asia and Africa, to anchor its operations and secure substantial market share. This localized approach is crucial for adapting distribution to diverse market needs and cultural contexts, driving deeper penetration.

The company's significant market dominance in edible oils within China, a key Asian market, exemplifies the success of this localized strategy. For instance, in 2023, Wilmar maintained a leading position in China's cooking oil market, reflecting its robust distribution network and understanding of local consumer preferences.

Wilmar International employs a robust multi-channel distribution strategy to ensure its diverse product portfolio reaches a broad consumer base. This includes traditional retail channels, modern supermarkets, convenience stores, and hypermarkets, making their consumer goods widely accessible across various shopping preferences and locations.

For their industrial segment, Wilmar focuses on direct sales and bulk distribution, efficiently serving business clients with essential agricultural commodities and ingredients. This dual approach effectively caters to both individual consumer needs and large-scale industrial requirements, demonstrating their market reach.

Integrated Logistics and Supply Chain Management

Wilmar International's integrated logistics and supply chain management is a cornerstone of its Place strategy, leveraging its vast vertical integration from farm to fork. This allows for unparalleled control over product flow, ensuring efficiency and reliability. For instance, in 2023, Wilmar's extensive network of processing plants and distribution centers across Asia and beyond facilitated the movement of millions of tons of agricultural commodities, directly impacting product availability and cost-effectiveness for consumers.

The company's logistical prowess is further amplified by its ownership of a substantial shipping fleet. This fleet, comprising both liquid and dry bulk vessels, is crucial for its global reach, enabling cost-efficient and timely transportation of raw materials and finished goods. This strategic asset management in 2024/2025 continues to be a key differentiator, allowing Wilmar to navigate fluctuating global shipping rates and maintain competitive pricing.

- Vertical Integration: Wilmar controls the entire supply chain, from sourcing raw materials to delivering finished products.

- Logistical Advantages: This integration optimizes efficiency, reduces lead times, and ensures consistent product availability.

- Global Transportation: The company operates a dedicated fleet of liquid and dry bulk vessels for international freight.

- 2023/2024 Impact: Wilmar's robust logistics network managed significant volumes, contributing to its market leadership in key agricultural sectors.

Food Parks and Commissary Business Expansion

Wilmar International is strategically expanding its food parks and commissary operations, with a notable focus on China. This expansion is designed to enhance their product reach by integrating manufacturing and distribution closer to consumers, thereby catering to the increasing demand for convenient, ready-to-eat meals and food service solutions. The company anticipates this move will unlock significant new revenue streams.

This initiative is a key component of Wilmar's 'Place' strategy, aiming to optimize its supply chain and market accessibility. By establishing more food parks and commissary hubs, Wilmar is positioning itself to capitalize on evolving consumer preferences for prepared foods. For instance, in 2024, Wilmar's China operations have seen a steady increase in demand for its food service offerings, driving the need for expanded infrastructure.

- Increased Operational Sites: Wilmar plans to substantially grow the number of its food park and commissary facilities, particularly in key Chinese markets.

- Supply Chain Integration: These facilities combine production and distribution to ensure products are readily available to end-consumers.

- Market Responsiveness: The expansion directly addresses the rising consumer appetite for convenient and prepared food options.

- Growth Engine Focus: This strategic push is intended to establish new growth avenues for the company in the rapidly evolving food sector.

Wilmar International's extensive global network, featuring over 1,000 manufacturing facilities and operations in approximately 50 countries, ensures widespread product availability. This vast infrastructure is a significant competitive advantage, allowing for efficient production and distribution, particularly in key markets like China and India.

The company's strategic use of regional hubs, especially in Asia and Africa, solidifies its market presence and facilitates adaptation to diverse local needs. Wilmar's dominance in China's edible oils market, for example, highlights the effectiveness of this localized distribution approach.

Wilmar employs a multi-channel distribution strategy, reaching consumers through traditional retail, modern supermarkets, and convenience stores. For its industrial clients, direct sales and bulk distribution are key, catering to both consumer and business demands efficiently.

The company's integrated logistics and substantial shipping fleet, comprising liquid and dry bulk vessels, are critical for its global reach and cost-effective transportation. This logistical prowess, a key differentiator in 2024/2025, ensures reliability and competitive pricing for its diverse product portfolio.

| Distribution Channel | Target Segment | Key Markets |

|---|---|---|

| Retail (Supermarkets, Convenience Stores) | Consumers | China, India, Indonesia, Southeast Asia |

| Food Service (Commissaries, Food Parks) | Food Businesses, End-Consumers | China (Expanding Focus) |

| Direct Sales & Bulk Distribution | Industrial Clients, Manufacturers | Global (Commodities & Ingredients) |

What You See Is What You Get

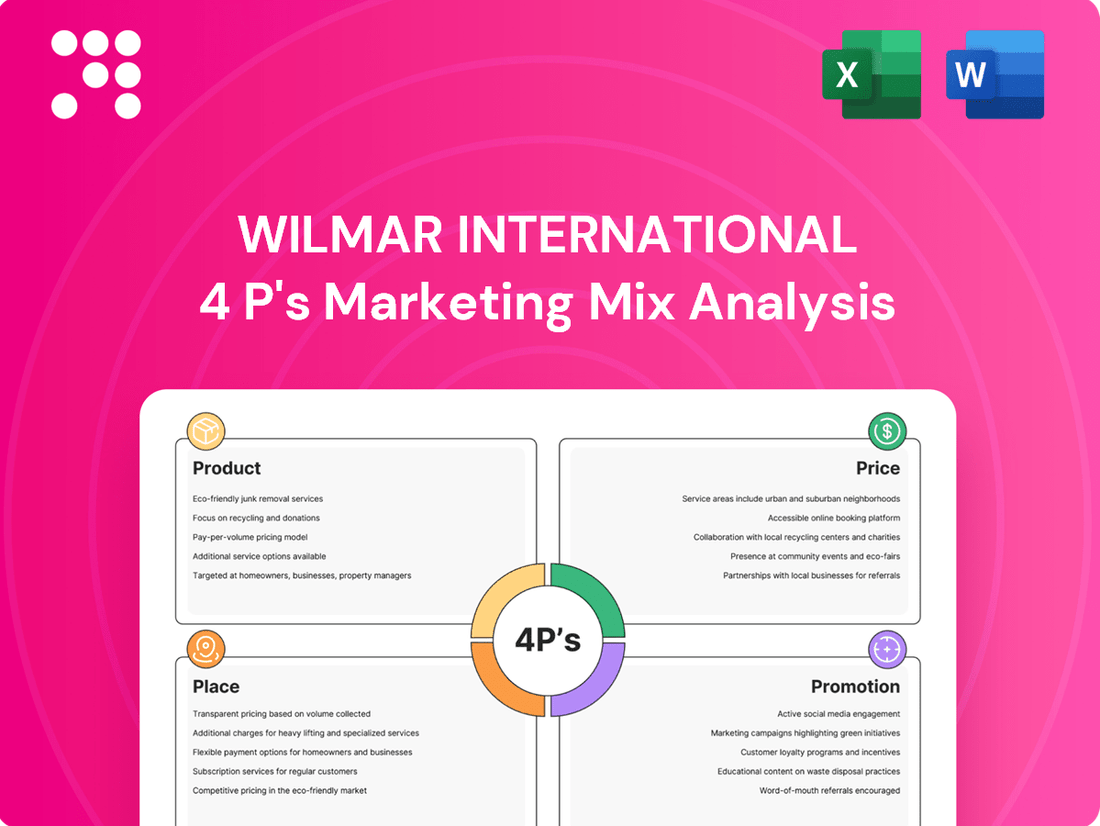

Wilmar International 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Wilmar International 4P's Marketing Mix Analysis is fully complete and ready for your immediate use, offering a detailed breakdown of their strategies.

Promotion

Wilmar International actively showcases its sustainability commitment through detailed annual reports and ESG disclosures. This transparency, covering responsible sourcing and climate action, bolsters its brand and meets stakeholder demands for ethical operations.

Key promotional highlights include validation of Wilmar's Net Zero targets by the Science Based Targets initiative (SBTi) and a strong rating from the FTSE4Good Index. These achievements underscore its leadership in environmental, social, and governance practices, further solidifying its market position.

Wilmar International actively utilizes strategic partnerships and joint ventures to broaden its market footprint and bolster brand recognition. A prime example is its collaboration with Kellogg Company in China, which aims to tap into the growing consumer demand for healthier food options. This alliance allows Wilmar to leverage Kellogg's established brand equity and distribution networks in a key Asian market.

Furthermore, Wilmar's increased stake in Adani Wilmar in India, a significant player in the edible oil sector, underscores its commitment to strengthening its presence in emerging economies. This move, finalized with Wilmar acquiring an additional 22.5% stake in Adani Wilmar, bringing its total ownership to 48.9%, enhances its competitive edge and market share in one of the world's largest edible oil markets. Such strategic alliances are crucial for market entry, optimizing distribution channels, and implementing co-promotional strategies that amplify brand visibility and consumer engagement.

Wilmar International is actively expanding its digital marketing efforts, employing online advertising and social media to connect with a wider consumer base. This digital push is crucial for gathering real-time consumer insights, helping them understand purchasing habits and preferences. For instance, in 2024, Wilmar reported a significant increase in engagement across its key digital platforms, directly correlating with targeted campaigns.

Brand Reputation for Quality and Health

Wilmar International heavily leverages its brand reputation for quality and health, a key element in its marketing mix. The company consistently promotes its food products as being of high quality and beneficial for consumer well-being. This commitment to excellence is evident in its well-regarded consumer brands, which frequently receive accolades that are then showcased in marketing campaigns to foster trust and encourage repeat purchases.

This emphasis on quality serves as a crucial differentiator for Wilmar's diverse product portfolio within crowded marketplaces. For instance, in 2024, Wilmar's edible oils segment, a significant contributor to its revenue, continued to benefit from consumer preference for brands perceived as healthier and more reliable. Wilmar's brands, such as those in the cooking oil category, have consistently ranked high in consumer surveys for perceived health benefits and product integrity in key Asian markets.

- Brand Recognition: Wilmar's consumer brands, like those in the edible oils and rice sectors, are often household names, built on years of consistent quality delivery.

- Health Messaging: Promotions frequently highlight attributes such as reduced cholesterol, added vitamins, or natural processing, aligning with growing consumer health consciousness.

- Award Recognition: Awards and certifications related to product quality, food safety, and health benefits are actively used in advertising to bolster consumer confidence.

- Market Differentiation: In 2024, this focus on health and quality allowed Wilmar brands to command a premium and maintain market share against competitors with less defined health or quality propositions.

Community Engagement and Social Impact Initiatives

Wilmar International actively participates in community engagement and social impact initiatives, a key aspect of its People strategy. These programs are frequently showcased in their sustainability reports and public relations efforts, reinforcing their image as a responsible corporate entity. For instance, in 2023, Wilmar continued its focus on farmer livelihoods and community development, investing in programs aimed at improving agricultural practices and access to education.

These initiatives resonate strongly with consumers who prioritize ethical business conduct, a trend that has become increasingly pronounced in recent years. Wilmar's commitment to social impact goes beyond mere philanthropy; it's integrated into their business model to build trust and long-term relationships. Their investment in employee training and development, alongside direct community contributions, exemplifies this commitment.

Specific examples of their social impact work include:

- Farmer Support Programs: In 2024, Wilmar continued to expand its outreach to smallholder farmers across Southeast Asia, providing training on sustainable farming techniques and offering access to better quality seeds and fertilizers. This directly impacts over 300,000 farmers, enhancing their yields and incomes.

- Educational Initiatives: The company supported educational programs in rural communities, including scholarships and school infrastructure development, benefiting approximately 15,000 students in 2023.

- Employee Development: Wilmar invested significantly in its workforce in 2024, with over 50,000 employees participating in various training and upskilling programs focused on safety, technical skills, and leadership.

Wilmar International's promotional strategy centers on building trust through transparency and highlighting its commitment to sustainability and quality. Its digital marketing efforts, including social media engagement, saw a significant increase in user interaction in 2024, directly linked to targeted campaigns. This approach, combined with strategic partnerships like the one with Kellogg in China, amplifies brand visibility and consumer connection.

Price

Wilmar International navigates fiercely competitive global agricultural commodity markets, where pricing for bulk goods like tropical oils, oilseeds, and grains is heavily influenced by international supply and demand, fluctuating commodity prices, and the actions of competitors. This intense environment necessitates a dynamic approach to pricing to remain competitive.

In 2023, Wilmar reported revenue of $59.5 billion, a slight decrease from $60.3 billion in 2022, reflecting the impact of softening commodity prices across its key segments. For instance, palm oil prices, a significant revenue driver, experienced volatility, impacting overall financial performance.

Wilmar International likely uses value-based pricing for its consumer food products, aligning prices with the quality, brand image, and convenience consumers expect. This strategy allows them to capture more value than they would with raw commodities, given their significant investments in brand building, attractive packaging, and widespread distribution networks.

This approach is supported by Wilmar's performance, as the company reported a notable increase in consumer products revenue. This growth was primarily driven by higher sales volumes, indicating that consumers found the value proposition compelling enough to purchase more of their branded offerings.

Wilmar's integrated model allows it to capture margins across its value chain, from oil refining to soybean crushing. This vertical integration fosters operational synergies and cost efficiencies, directly influencing its pricing competitiveness. For instance, refining margins for tropical oils and crushing margins for soybeans are critical drivers of profitability, even in segments facing margin pressure.

Impact of External Factors and Market Conditions

Wilmar International's pricing strategy is deeply intertwined with external forces. Fluctuating commodity prices, a volatile global economic landscape, and regional market demands, particularly in China, all play a crucial role in shaping their pricing decisions. For instance, the company's 2024 financial results were notably affected by a slowdown in China and softer commodity prices across the board, impacting the sugar division's performance.

These market conditions directly influence Wilmar's ability to set and maintain competitive prices. The company navigates these challenges by adapting its strategies to align with prevailing economic trends and consumer purchasing power in its key operating regions.

- Commodity Price Volatility: Wilmar's profitability is sensitive to price swings in key commodities like palm oil, sugar, and grains, impacting its cost of goods sold and final product pricing.

- Global Economic Conditions: Broader economic downturns or growth spurts influence consumer spending and demand for food products, forcing price adjustments.

- Regional Market Dynamics: Consumer demand and competitive pricing in major markets, such as China, are critical determinants of Wilmar's pricing power.

- 2024 Performance Impact: Weaker performance in China and the sugar segment, coupled with softened commodity prices, underscored the direct impact of these external factors on Wilmar's financial outcomes.

Dividend Policy and Shareholder Value

Wilmar International's dividend policy acts as a crucial element in its shareholder value proposition, indirectly signaling its pricing strategy through demonstrated financial strength. The company's commitment to consistent and generous dividend payouts, which have reached historically high indicative yields, attracts investors and bolsters market confidence in its underlying profitability and efficient operations.

This focus on shareholder returns, exemplified by its dividend payouts, suggests a pricing strategy that supports robust earnings, allowing for attractive distributions. For instance, Wilmar's strong financial performance in recent periods, leading to these enhanced dividend yields, underscores its ability to generate substantial profits that can be shared with its owners.

- Consistent Dividend Payouts: Wilmar has a history of rewarding shareholders, indicating stable and profitable operations.

- Historically High Indicative Yield: Recent performance has pushed the company's dividend yield to notable highs, enhancing its attractiveness.

- Shareholder Value Focus: The dividend policy directly contributes to increasing shareholder value, influencing investor perception and market valuation.

- Indirect Pricing Signal: Generous dividends suggest a pricing strategy that supports strong profitability and cash flow generation.

Wilmar International's pricing strategy for its commodity products is largely dictated by global market forces, with prices for palm oil, sugar, and grains fluctuating based on supply, demand, and geopolitical events. For its consumer-facing brands, the company employs value-based pricing, reflecting product quality and brand equity, which contributed to increased consumer product revenue in recent periods.

The company's integrated business model, spanning from raw material processing to finished goods, allows for cost efficiencies that underpin its pricing competitiveness. For example, Wilmar's refining and crushing margins are key indicators of its ability to manage costs and set competitive prices, especially in the face of volatile input costs.

External factors significantly influence Wilmar's pricing decisions, including economic slowdowns in key markets like China and broader commodity price softening. These dynamics were evident in 2023, where revenue saw a slight dip to $59.5 billion from $60.3 billion in 2022, reflecting these market pressures.

Wilmar's dividend policy, which has seen historically high indicative yields, indirectly signals a pricing strategy that supports robust profitability and cash flow generation, thereby enhancing shareholder value.

| Segment | 2023 Revenue (USD Billion) | Key Pricing Influences |

|---|---|---|

| Tropical Oils | 23.1 | Global supply/demand, palm oil price volatility |

| Oilseeds & Grains | 25.5 | Weather patterns, geopolitical factors, input costs |

| Sugar | 7.2 | Global sugar prices, regional demand (e.g., China) |

| Consumer Products | N/A (included in other segments) | Brand equity, perceived value, competitor pricing |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Wilmar International is grounded in comprehensive data, including official annual reports, investor relations materials, and public company filings. We also incorporate insights from industry-specific research and competitive market intelligence to ensure accuracy.