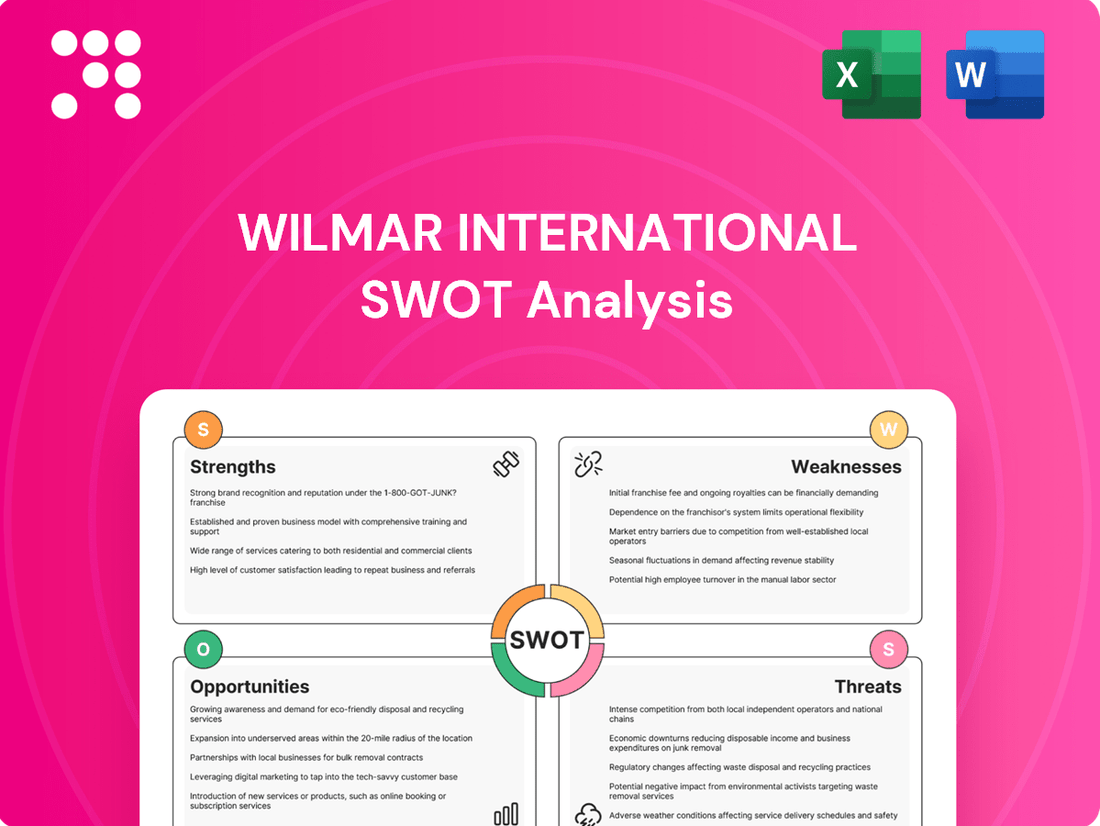

Wilmar International SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Wilmar International Bundle

Wilmar International, a global agribusiness leader, navigates a complex market landscape. While its extensive supply chain and diversified product portfolio present significant strengths, the company also faces challenges like fluctuating commodity prices and increasing regulatory scrutiny. Understanding these dynamics is crucial for any stakeholder.

Want the full story behind Wilmar International's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Wilmar International's integrated business model, spanning cultivation to distribution, provides significant control over its supply chain. This vertical integration, evident in its 2023 financial performance where revenue reached $69.05 billion, allows for optimized costs and consistent quality across its diverse product portfolio.

The company's extensive global reach, boasting over 400 manufacturing facilities and a robust distribution network across Asia, Africa, and beyond, is a key strength. This infrastructure, supporting its operations in over 50 countries, enables Wilmar to efficiently serve a wide array of markets and consumer segments, reinforcing its competitive position.

Wilmar International commands significant market leadership across several core agribusiness sectors. It stands as the globe's foremost player in edible oil processing and merchandising, and is the largest global producer of oleochemicals, specialty fats, and palm biodiesel.

Furthermore, Wilmar is among the world's largest owners of oil palm plantations, demonstrating its extensive upstream capabilities. In Asia, the company is a leading force in oilseed crushing and milling of rice and flour, solidifying its comprehensive reach within the food value chain.

Wilmar International boasts a strong foothold in high-growth regions, including China, India, Indonesia, Malaysia, Vietnam, and various African nations. This strategic positioning allows the company to capitalize on expanding consumer bases and increasing demand for its products.

Its significant subsidiary, Yihai Kerry Arawana (YKA) in China, is a major contributor to the group's profitability. YKA has demonstrated resilience, particularly with the recovery observed in its catering and food service segments, indicating sustained demand even amidst market fluctuations.

Further strengthening its presence, Wilmar has made strategic investments, such as increasing its stake in AWL Agri Business in India. This move underscores its commitment to solidifying its operations in key developing markets, anticipating continued growth and market share expansion.

Commitment to Sustainability and ESG Leadership

Wilmar International's unwavering commitment to sustainability and Environmental, Social, and Governance (ESG) leadership is a significant strength. The company's No Deforestation, No Peat, No Exploitation (NDPE) Policy, coupled with its inclusion in the Dow Jones Sustainability Indices World Index, highlights its dedication to responsible operations. Furthermore, Wilmar has set ambitious science-based targets for emissions reduction and is making substantial progress towards its 2024 goal of 100% traceability to palm oil mills, with a further target for plantations by 2025.

This focus on sustainability translates into tangible actions and recognition:

- NDPE Policy: A core pillar of its responsible sourcing strategy.

- Dow Jones Sustainability Indices: Consistent inclusion demonstrates strong ESG performance.

- Science-Based Targets: Commitment to measurable emissions reductions.

- Traceability Goals: Aiming for 100% traceability to mills by 2024 and plantations by 2025, enhancing supply chain transparency.

Resilient Financial Performance and Strategic Investments

Wilmar International has demonstrated remarkable resilience in its financial performance, navigating market volatilities effectively. Analysts project an earnings recovery for the company in 2025, underscoring its robust operational capabilities.

The company's strategic emphasis on growing its food products segment, coupled with favorable soybean crushing margins, significantly bolsters its financial stability. This strategic alignment is a key driver of its sustained performance.

Wilmar's financial strength is further evidenced by its improving net gearing ratio and substantial unutilized banking facilities, positioning it well for future expansion and investment opportunities.

- Resilient Earnings: Anticipated earnings recovery in 2025 following market volatilities.

- Strategic Growth: Expansion in the food products segment and favorable crushing margins.

- Financial Stability: Improvement in net gearing ratio and significant unutilized banking facilities.

Wilmar's integrated business model, from cultivation to distribution, grants substantial supply chain control, contributing to its $69.05 billion revenue in 2023 and optimized costs.

Its extensive global presence, with over 400 manufacturing facilities and operations in more than 50 countries, ensures efficient market reach and reinforces its competitive advantage.

The company holds dominant market positions globally in edible oils, oleochemicals, and specialty fats, alongside significant upstream plantation ownership.

Wilmar's strategic focus on high-growth regions like China and India, supported by key subsidiaries such as Yihai Kerry Arawana, positions it for continued expansion and market penetration.

A strong commitment to sustainability, including its NDPE policy and traceability goals for 2024 and 2025, enhances its reputation and operational integrity.

Financial resilience is a key strength, with projected earnings recovery in 2025, favorable crushing margins, and a healthy financial position evidenced by its net gearing ratio and available banking facilities.

What is included in the product

Analyzes Wilmar International’s competitive position through key internal and external factors, highlighting its integrated business model and market leadership while also addressing potential supply chain vulnerabilities and regulatory challenges.

Offers a clear, actionable framework to navigate Wilmar's complex global operations and identify key strategic advantages and challenges.

Weaknesses

Wilmar International's profitability is heavily tied to the unpredictable swings in global commodity prices, such as palm oil, sugar, and soybeans. Even with its integrated business model, significant price drops or poor refining and crushing margins can directly hurt its earnings. For instance, the company faced challenging conditions in its tropical oils business during recent periods, highlighting this vulnerability.

Wilmar International grapples with significant regulatory and legal hurdles in Indonesia, a critical hub for its operations. The company has faced investigations concerning alleged mislabeling of rice and corruption allegations tied to palm oil export permits. These legal entanglements resulted in substantial security deposits, with the risk of forfeiture, impacting its financial stability and operational continuity.

While Wilmar International has seen growth in many of its core businesses, certain segments have faced headwinds. For instance, the sugar merchandising division and some industrial product lines have reported declining earnings. This uneven performance across different business units can impact the company's overall financial health, necessitating a focused approach to revitalize underperforming areas.

Challenges in China Market Consumption

Wilmar International faces significant headwinds in China, a crucial market for its food segment. Weak consumer sentiment and subdued demand directly impacted sales volumes and profitability in 2024. For instance, while specific year-end figures for China's consumption impact on Wilmar are still emerging, broader economic indicators from the National Bureau of Statistics of China showed retail sales growth slowing to 3.1% year-on-year in the first quarter of 2024, down from 7.4% in the same period of 2023, highlighting the challenging environment.

The company's management acknowledges this, expressing cautious optimism for a recovery. However, the risk of prolonged downtrading or persistently weak consumer spending in China remains a key concern, potentially continuing to weigh on Wilmar's earnings from this vital region throughout 2025.

- Subdued Consumer Spending: China's retail sales growth deceleration in early 2024 indicates a challenging consumption environment.

- Impact on Volumes: Weak demand directly affects Wilmar's sales volumes for its extensive food product portfolio.

- Profitability Pressure: Downtrading by consumers seeking lower-priced alternatives can compress profit margins.

- Uncertain Recovery: The duration and extent of the consumer sentiment recovery in China remain a significant risk factor for Wilmar's financial performance.

Complexity in Achieving Full Supply Chain Transparency

Wilmar International faces challenges in achieving complete supply chain transparency, especially within its vast and intricate commodity trading networks in key markets like China and India. This complexity can impede the thorough implementation and verification of sustainable practices across its operations.

The sheer scale of Wilmar's global operations, involving numerous suppliers and intricate logistics, makes it difficult to track every product from origin to destination. This lack of granular visibility can create blind spots, potentially masking unsustainable practices or making it harder to address issues like deforestation or labor rights effectively.

- Difficulty in tracing raw materials: Wilmar's extensive sourcing from diverse regions, often through intermediaries, complicates the direct traceability of every ingredient back to its farm of origin.

- Data integration challenges: Consolidating and verifying data from various partners and systems across different countries, each with unique regulatory environments, presents a significant hurdle to achieving unified transparency.

- Verification of sustainable practices: While Wilmar has set sustainability targets, ensuring that all suppliers and partners consistently adhere to these standards throughout the entire supply chain requires robust and continuous auditing, which is resource-intensive.

Wilmar's profitability is highly sensitive to volatile global commodity prices, impacting its refining and crushing margins. For example, the company experienced significant challenges in its tropical oils segment during recent periods due to price fluctuations. Furthermore, uneven performance across business units, such as declining earnings in sugar merchandising, can affect overall financial health and necessitate strategic revitalization efforts for underperforming areas.

What You See Is What You Get

Wilmar International SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing the actual Wilmar International SWOT analysis, offering a comprehensive overview of its strategic position. The full, detailed report is unlocked upon purchase.

Opportunities

Wilmar International is well-positioned for growth by expanding its presence in high-growth consumer markets, particularly within its food products segment. The company's established reputation for quality and healthy food options provides a solid foundation for increasing market share. For instance, Wilmar's move to increase its stake in AWL Agri Business in India directly targets the rapidly expanding packaged food and edible oil sectors in this key emerging economy.

Wilmar International can significantly boost its market presence by investing in advanced digital marketing strategies and leveraging sophisticated consumer insights. By prioritizing market research and competitive analysis, Wilmar can gain deeper insights into consumer behavior and emerging trends, as evidenced by the global digital ad spending projected to reach $678.8 billion in 2024, with a further increase to $746.9 billion anticipated for 2025.

Utilizing digital marketing tactics can enhance its reach to a broader audience, allowing for more targeted marketing initiatives that resonate with diverse audiences and preferences across various regions. For instance, personalized digital campaigns, informed by data analytics, can improve customer engagement and conversion rates, a crucial factor in the competitive agribusiness landscape where Wilmar operates.

Strategic partnerships and joint ventures are a key avenue for Wilmar International's growth. For instance, their past collaboration with Kellogg Company in China demonstrates how such alliances can facilitate market entry and leverage existing distribution networks. More recently, their Nigerian edible oils joint venture highlights a strategy to enhance capabilities and expand reach in emerging markets, directly contributing to the group's revenue streams.

Recovery in Global Commodity Markets and Crushing Margins

Wilmar International anticipates a significant earnings recovery in 2025, buoyed by a positive outlook for its oilseeds division. This optimism is largely fueled by projections of record soybean crop production in Brazil, a key sourcing region for the company.

Improved crushing margins, particularly for soybeans, are expected to drive a rebound in the feed and industrial products segment. This could translate to a substantial boost in Wilmar's overall profitability for the upcoming fiscal year.

- 2025 Earnings Outlook: Cautiously optimistic, driven by global commodity market recovery.

- Key Driver: Expected record soybean crop production in Brazil.

- Margin Improvement: Anticipated increase in soybean crushing margins.

- Segment Impact: Positive effect on feed and industrial products, boosting overall profitability.

Advancing Sustainability and ESG Initiatives

Wilmar International can significantly boost its standing by deepening its commitment to sustainability and Environmental, Social, and Governance (ESG) principles. This focus on conservation, climate action, and community engagement is crucial for enhancing brand image and appealing to a growing segment of ESG-conscious investors. For instance, Wilmar's 2023 sustainability report highlighted a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to their 2020 baseline, a tangible step that resonates with investors prioritizing climate action.

Continuing to make strides toward net-zero emissions and reinforcing responsible sourcing practices are key differentiators in a crowded marketplace. These efforts not only build trust with consumers and partners but also can unlock better access to green financing and preferential loan terms. Wilmar's investment in traceable supply chains, with over 90% of its palm oil sourced from traceable origins as of late 2024, directly supports these initiatives and strengthens its competitive edge.

- Enhanced Brand Reputation: A stronger sustainability profile attracts environmentally and socially conscious consumers and business partners.

- Investor Appeal: Increased focus on ESG metrics can attract a larger pool of ESG-focused investment funds, potentially lowering the cost of capital.

- Market Differentiation: Achieving net-zero targets and ensuring responsible sourcing sets Wilmar apart from competitors.

- Access to Sustainable Financing: Demonstrable progress in sustainability can lead to improved access to green bonds and sustainability-linked loans, which often carry more favorable terms.

Wilmar International's strategic expansion into high-growth consumer markets, particularly in food products, presents a significant opportunity for increased market share. The company's focus on quality and healthy options, exemplified by its increased stake in AWL Agri Business in India, targets the burgeoning packaged food and edible oil sectors.

Leveraging advanced digital marketing and consumer insights is another key avenue for growth, with global digital ad spending projected to reach $746.9 billion by 2025. This allows for more targeted campaigns, enhancing customer engagement and conversion rates in a competitive agribusiness landscape.

Strategic partnerships, like the recent Nigerian edible oils joint venture, offer a pathway to enhance capabilities and expand reach in emerging markets, directly contributing to revenue growth.

Wilmar's positive 2025 earnings outlook is bolstered by an anticipated record soybean crop in Brazil, which is expected to improve crushing margins and boost the feed and industrial products segment.

Furthermore, a deepened commitment to sustainability and ESG principles, including a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity by late 2024, enhances brand reputation and attracts ESG-conscious investors, potentially improving access to favorable financing.

| Opportunity Area | Key Driver | 2024/2025 Data/Projection | Impact |

|---|---|---|---|

| Market Expansion (Food Products) | Growing consumer demand in emerging economies | India's packaged food market projected to grow significantly | Increased market share and revenue |

| Digital Marketing & Consumer Insights | Rising global digital ad spend | Projected global digital ad spend of $746.9 billion in 2025 | Enhanced customer engagement and conversion |

| Strategic Partnerships | Access to new markets and capabilities | Nigerian edible oils joint venture | Revenue stream enhancement and expanded reach |

| Commodity Market Recovery (Oilseeds) | Record soybean crop production in Brazil | Expected record Brazilian soybean crop | Improved crushing margins and segment profitability |

| Sustainability & ESG Focus | Growing investor and consumer preference | 15% reduction in GHG emissions intensity (Scope 1 & 2) by late 2024 | Improved brand reputation and access to green financing |

Threats

Wilmar International faces intensified regulatory scrutiny, particularly concerning its palm oil operations in Indonesia. Ongoing investigations into export permits and potential legal appeals present significant financial and reputational risks. For example, adverse court rulings could lead to substantial penalties, impacting the company's liquidity and potentially shaking investor confidence.

The escalating geopolitical volatility, exemplified by new US tariffs and ongoing trade disputes, poses a significant threat to Wilmar International. These tensions can directly inflate operational risks and expenses, impacting its extensive global footprint.

Disruptions to intricate supply chains and volatility in commodity prices, such as palm oil and sugar, are direct consequences of these geopolitical shifts. This uncertainty clouds Wilmar's earnings outlook, making financial forecasting more challenging for the 2024-2025 period.

Wilmar International faces ongoing challenges with crude palm oil (CPO) and sugar prices. While some business areas might see recovery, the palm oil refining segment is still grappling with margin pressures. Looking ahead to 2025, sugar prices are anticipated to stay relatively weak.

Significant declines in CPO prices can directly impact Wilmar's plantation and sugar milling operations. These drops can reduce the profitability of these segments, consequently lowering their overall contribution to the company's financial performance. For instance, CPO prices experienced volatility throughout 2024, impacting margins for refiners.

Increased Competition and Shifting Consumer Preferences

The agribusiness landscape is intensely competitive, and Wilmar International faces the challenge of evolving consumer tastes. For instance, a notable trend in markets like China involves a growing preference for more budget-friendly food options. This shift directly influences Wilmar's product assortment and profit margins within its crucial food segment, necessitating ongoing innovation to secure market position and profitability.

Wilmar's financial reports from 2023 and early 2024 indicate that while revenue remained robust, maintaining premium pricing in the face of affordability demands requires strategic adjustments. The company's food products segment, a significant contributor to its overall performance, is particularly susceptible to these consumer preference dynamics.

- Intensified Competition: Wilmar operates in a sector with numerous global and regional players vying for market share.

- Consumer Preference Shifts: A move towards value-oriented products in key markets like China pressures margins in Wilmar's food business.

- Adaptation Necessity: Continuous product development and marketing strategies are vital to counter these competitive and preference-driven threats.

Climate Change Impacts on Agricultural Production

Wilmar International, as a significant player in agribusiness, faces substantial threats from climate change. Extreme weather events, such as prolonged droughts or intense flooding, directly impact crop yields, particularly for key commodities like palm oil and sugar. For instance, in 2024, several Southeast Asian regions experienced unseasonable rainfall patterns, which led to concerns about reduced sugar cane harvests, a critical input for Wilmar's refining operations.

Changes in rainfall patterns and rising global temperatures can disrupt agricultural cycles, potentially leading to production shortfalls. This directly affects Wilmar's supply chain, increasing the risk of material shortages and driving up input costs. The company's reliance on oil palm, for example, makes it susceptible to the effects of hotter, drier conditions which can stunt growth and reduce oil extraction rates.

These climate-related challenges translate into increased operational costs for Wilmar. Farmers may need to invest more in irrigation, pest control, and resilient crop varieties to mitigate the impacts. Furthermore, potential production shortfalls could necessitate sourcing from more expensive or distant locations, impacting Wilmar's profitability and market competitiveness.

- Extreme weather events: Increased frequency and intensity of droughts, floods, and storms directly impact crop yields.

- Altered rainfall patterns: Unpredictable rainfall can disrupt planting and harvesting cycles, affecting commodity availability.

- Rising temperatures: Higher temperatures can stress crops, reduce productivity, and increase water demand for irrigation.

- Increased operational costs: Mitigation strategies and potential supply chain disruptions lead to higher expenses for Wilmar.

Wilmar International faces significant threats from evolving consumer preferences, particularly a growing demand for more budget-friendly food options in key markets like China, which can pressure profit margins in its food segment. Additionally, the company is susceptible to volatile commodity prices, with crude palm oil (CPO) and sugar prices impacting plantation and refining operations, and sugar prices expected to remain weak into 2025.

Intensified competition within the agribusiness sector requires continuous product innovation and strategic marketing to maintain market share. Geopolitical volatility, including trade disputes and potential new tariffs, adds another layer of risk, potentially increasing operational costs and disrupting Wilmar's extensive global supply chains throughout 2024 and 2025.

Climate change presents a substantial threat, with extreme weather events like droughts and floods directly impacting crop yields for palm oil and sugar, potentially leading to production shortfalls and increased operational costs due to the need for mitigation strategies and sourcing from potentially more expensive locations.

Regulatory scrutiny, especially concerning palm oil operations in Indonesia, poses financial and reputational risks, with adverse court rulings potentially leading to significant penalties and impacting investor confidence.

| Threat Category | Specific Threat | Impact on Wilmar | 2024-2025 Relevance |

| Consumer Preferences | Shift to budget-friendly options in China | Pressure on food segment margins | Ongoing challenge for product assortment |

| Commodity Prices | Volatile CPO and weak sugar prices | Reduced profitability in plantations and refining | Sugar prices projected to remain weak in 2025 |

| Competition | Intense agribusiness competition | Necessity for continuous innovation | Crucial for market share maintenance |

| Geopolitics | Trade disputes, tariffs | Increased operational costs, supply chain disruption | Directly impacts global footprint |

| Climate Change | Extreme weather, altered rainfall | Reduced crop yields, increased operational costs | Affects key commodities like palm oil and sugar |

| Regulation | Scrutiny on Indonesian palm oil operations | Financial penalties, reputational damage | Potential for legal appeals and adverse rulings |

SWOT Analysis Data Sources

This Wilmar International SWOT analysis is built upon a foundation of credible data, including their latest financial reports, comprehensive market research on the agribusiness sector, and insights from industry experts and reputable news outlets.